Social Sciences

China's premier, Wen Jiabao, criticized the United States last week for its insistence that China revalue its currency, the RMB. A great deal of western commentary has declared that in the summer of 2008, when storm clouds appeared ahead of the global financial collapse, China "re-pegged" its currency to the U.S. dollar, fundamentally changing its exchange rate policy.

Here is how the Financial Times put it as it told the story of Premier Wen's criticism: "The renminbi has been repegged to the US dollar since mid-2008, putting on ice the Chinese currency?s tightly managed rise during the previous three years against the dollar." (Patti Waldmeier, "Wen labels renminbi pressure 'unfair,'" Financial Times, 30 November 2009)

But there is another way to look at Chinese exchange rate policy. It suggests that the "re-pegged" story isn't the whole story, and may not be the real story at all.

Since July 2005, China has said it follows what it calls a "managed float" taking "guidance" from a basket of currencies rather than just pegging to the U.S. dollar. In other words, even though the actual mixture of currencies in the basket isn't clear, China's "new" policy announced back then was to follow a basket that most likely had heavy weights for the U.S. dollar, the euro and the Japanese yen.

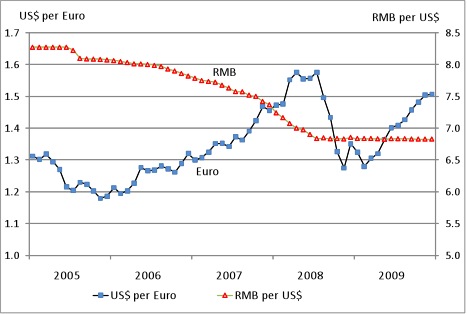

Accordingly, through July 2008, as the euro strengthened against the U.S. dollar, it was only natural that the RMB strengthen against the dollar, too. That is, the RMB revalued against the dollar, but just not as much as the euro did. After all, this is what basket guidance would indicate: if the euro strengthens against the dollar, so should the RMB, only not as much, because it is following a mix of currencies, not just the euro.

By the same token, if the euro were suddenly to weaken against the dollar, basket guidance would say that China should devalue the RMB against the U.S. dollar, although not as much as the euro.

It turns out that in July 2008, as panic over global financial conditions spread, the euro did in fact suddenly stop strengthening and started weakening against the dollar--by quite a lot. But did the RMB then follow basket guidance and reverse course, devaluing against the dollar? No, it did not. Instead it just held steady to the dollar.

Why didn't it devalue against the dollar? Who knows. But a good guess is that China's leaders were concerned how this would be interpreted in America, especially during a presidential election campaign in which China hadn't been a major issue. As a consequence, the RMB ended up revaluing much more, on a trade-weighted basis, than its basket guidance would have indicated. The main indicator of this decision was a strong RMB revaluation against the euro.

Now, it turns out that as of this autumn, as of this week, the U.S. dollar and the euro haven't yet gotten back to the relationship they had when the Chinese leadership decided not to devalue against the U.S. dollar. The euro is still weaker against the dollar than it was in July 2008.

Instead of a "re-peg" to the dollar, the more likely Chinese policy is to follow basket guidance unless that guidance says to devalue against the dollar. Under such conditions, the policy would be to stay with the dollar and not follow the euro down. Ultimately, if and when the euro re-strengthens back to the point where it was in July 2008 (with some more minor adjustments for the Japanese yen) and then continues to revalue even further, the RMB would resume its revaluation against the dollar. This point is somewhere around US$1.60 per euro. So, to summarize the likely actual Chinese policy, it was and is basket guidance, unless the basket says devalue against the dollar.

The following diagram illustrates the relevant relationships between the euro and dollar exchange rates with respect to the RMB.

Albert Keidel

APP Senior Fellow

- Research In Centre For Studies In Science Policy: Cfps 18th International Euro-asia Research Confere...

Research in Centre for Studies in Science Policy: CfPs 18th International Euro-Asia Research Confere...: The 18th International Euro-Asia Research Conference Venezia, Italy January 31 to February 1st, 2013 Call for Papers "The Globalisation of A......

- The Economic Crisis And The Process Of European Integration

The Economic Crisis and the Process of European Integration 2 June 2010 Brussels, Belgium Core subjects: The Economic Crisis and Global Economic Imbalances; The US Dollar: an international reserve currency for the future?; The Euro Perspective in East...

- China's Yuan

Asia Policy Point Presents WHY THE CHINESE YUAN IS NOT UNDERVALUEDIt is the dollar that is vastly overvalued not only against the Yuan, but also the yen, the won, and the Taiwanese dollar. With Eamonn Fingleton Friday, December 10, 2010, 9:00-10:15...

- App's Al Keidel To Speak On China's Economy

CHINA AT MULTIPLE CROSSROADS: THE STATE AND TRAJECTORY OF CHINA?S ECONOMIC GROWTH. 7/15, 10:00am-Noon, Washington, DC. Sponsors: Atlantic Council; US Chamber of Commerce. Speakers: Albert Keidel, Senior Fellow, Asia Program, Atlantic Council, Senior Fellow...

- Reinventing The Chiang Mai Initiative

William W. Grimes, associate professor of international relations at Boston University, founding director of the Boston University Center for the Study of Asia, and APP member will be in Tokyo this week to discuss his book Currency and Contest in East...

Social Sciences

Is the RMB really "re-pegged" to the US$?

China's premier, Wen Jiabao, criticized the United States last week for its insistence that China revalue its currency, the RMB. A great deal of western commentary has declared that in the summer of 2008, when storm clouds appeared ahead of the global financial collapse, China "re-pegged" its currency to the U.S. dollar, fundamentally changing its exchange rate policy.

Here is how the Financial Times put it as it told the story of Premier Wen's criticism: "The renminbi has been repegged to the US dollar since mid-2008, putting on ice the Chinese currency?s tightly managed rise during the previous three years against the dollar." (Patti Waldmeier, "Wen labels renminbi pressure 'unfair,'" Financial Times, 30 November 2009)

But there is another way to look at Chinese exchange rate policy. It suggests that the "re-pegged" story isn't the whole story, and may not be the real story at all.

Since July 2005, China has said it follows what it calls a "managed float" taking "guidance" from a basket of currencies rather than just pegging to the U.S. dollar. In other words, even though the actual mixture of currencies in the basket isn't clear, China's "new" policy announced back then was to follow a basket that most likely had heavy weights for the U.S. dollar, the euro and the Japanese yen.

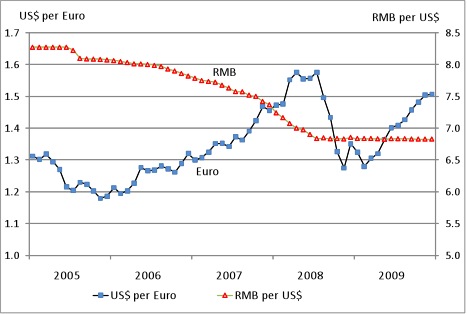

Accordingly, through July 2008, as the euro strengthened against the U.S. dollar, it was only natural that the RMB strengthen against the dollar, too. That is, the RMB revalued against the dollar, but just not as much as the euro did. After all, this is what basket guidance would indicate: if the euro strengthens against the dollar, so should the RMB, only not as much, because it is following a mix of currencies, not just the euro.

By the same token, if the euro were suddenly to weaken against the dollar, basket guidance would say that China should devalue the RMB against the U.S. dollar, although not as much as the euro.

It turns out that in July 2008, as panic over global financial conditions spread, the euro did in fact suddenly stop strengthening and started weakening against the dollar--by quite a lot. But did the RMB then follow basket guidance and reverse course, devaluing against the dollar? No, it did not. Instead it just held steady to the dollar.

Why didn't it devalue against the dollar? Who knows. But a good guess is that China's leaders were concerned how this would be interpreted in America, especially during a presidential election campaign in which China hadn't been a major issue. As a consequence, the RMB ended up revaluing much more, on a trade-weighted basis, than its basket guidance would have indicated. The main indicator of this decision was a strong RMB revaluation against the euro.

Now, it turns out that as of this autumn, as of this week, the U.S. dollar and the euro haven't yet gotten back to the relationship they had when the Chinese leadership decided not to devalue against the U.S. dollar. The euro is still weaker against the dollar than it was in July 2008.

Instead of a "re-peg" to the dollar, the more likely Chinese policy is to follow basket guidance unless that guidance says to devalue against the dollar. Under such conditions, the policy would be to stay with the dollar and not follow the euro down. Ultimately, if and when the euro re-strengthens back to the point where it was in July 2008 (with some more minor adjustments for the Japanese yen) and then continues to revalue even further, the RMB would resume its revaluation against the dollar. This point is somewhere around US$1.60 per euro. So, to summarize the likely actual Chinese policy, it was and is basket guidance, unless the basket says devalue against the dollar.

The following diagram illustrates the relevant relationships between the euro and dollar exchange rates with respect to the RMB.

Albert Keidel

APP Senior Fellow

- Research In Centre For Studies In Science Policy: Cfps 18th International Euro-asia Research Confere...

Research in Centre for Studies in Science Policy: CfPs 18th International Euro-Asia Research Confere...: The 18th International Euro-Asia Research Conference Venezia, Italy January 31 to February 1st, 2013 Call for Papers "The Globalisation of A......

- The Economic Crisis And The Process Of European Integration

The Economic Crisis and the Process of European Integration 2 June 2010 Brussels, Belgium Core subjects: The Economic Crisis and Global Economic Imbalances; The US Dollar: an international reserve currency for the future?; The Euro Perspective in East...

- China's Yuan

Asia Policy Point Presents WHY THE CHINESE YUAN IS NOT UNDERVALUEDIt is the dollar that is vastly overvalued not only against the Yuan, but also the yen, the won, and the Taiwanese dollar. With Eamonn Fingleton Friday, December 10, 2010, 9:00-10:15...

- App's Al Keidel To Speak On China's Economy

CHINA AT MULTIPLE CROSSROADS: THE STATE AND TRAJECTORY OF CHINA?S ECONOMIC GROWTH. 7/15, 10:00am-Noon, Washington, DC. Sponsors: Atlantic Council; US Chamber of Commerce. Speakers: Albert Keidel, Senior Fellow, Asia Program, Atlantic Council, Senior Fellow...

- Reinventing The Chiang Mai Initiative

William W. Grimes, associate professor of international relations at Boston University, founding director of the Boston University Center for the Study of Asia, and APP member will be in Tokyo this week to discuss his book Currency and Contest in East...